GERMANY’S URBAN HOUSING RECESSION IS COMING TO AN END

(Bloomberg) -- Less than a 30-minute walk along Rhine River from Cologne’s world famous cathedral, homes with oak flooring, spacious patios and spa-like bathrooms were on sale until recently for discounts, which could amount to as much as €57,000 ($62,000).

Offered by the developer of the 300-unit Viva Agrippina project, the deal was intended to stimulate demand after would-be buyers were left in a “state of shock” when the European Central Bank raised interest rates in 2022 to propel a surge in mortgage costs, said Anett Barsch, head of project development at the German unit of Swiss Life Asset Managers.

Unfortunately, people who missed the sweetener are now out of luck. The recession in German urban residential property, which prompted the rare rebate, is coming to an end. Driving the turnaround is an intensifying housing shortage in key cities as Germany’s dynamics catch up to much of the rest of Europe.

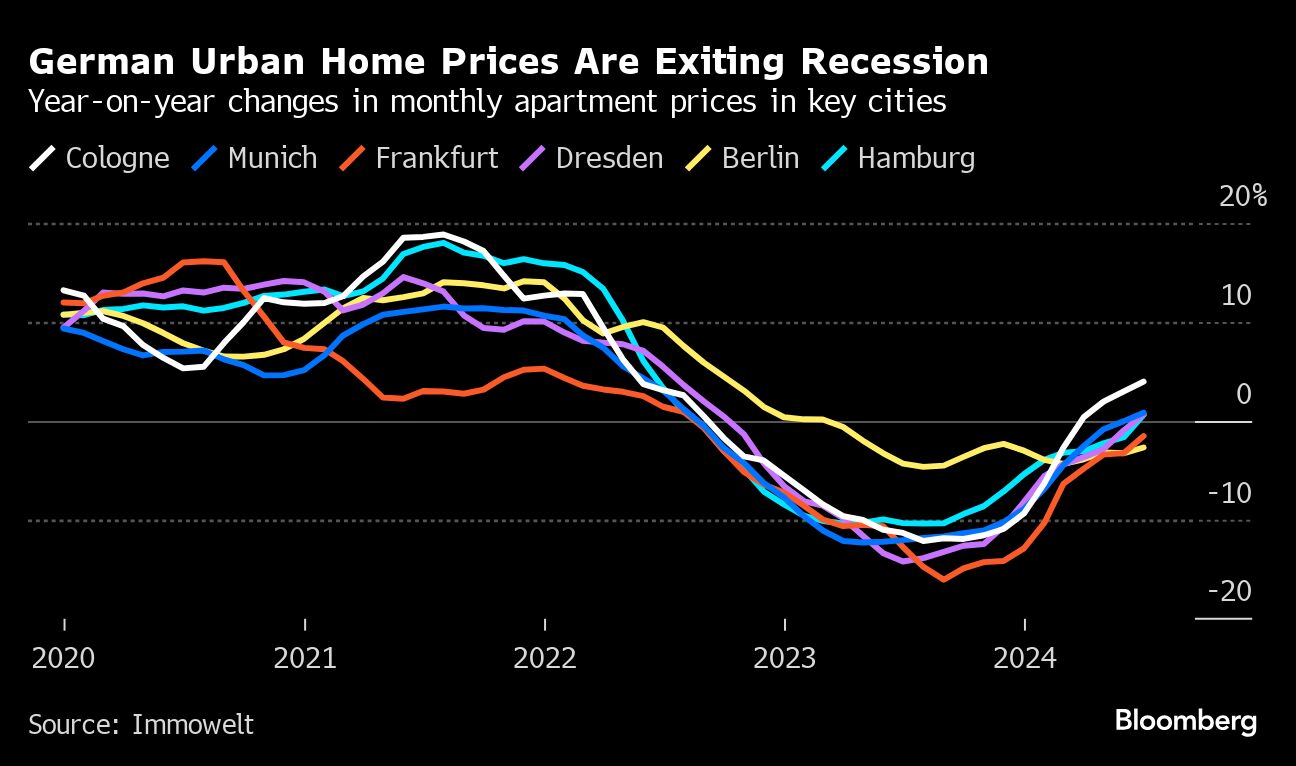

In Cologne, home prices have been rising for four consecutive months and were up 4% in June compared to a year earlier, according to a Bloomberg analysis of data from online real estate platform Immowelt. Other German cities are also ending a two-year slump.

Munich — historically Germany’s most expensive real estate market — rose in June for the first time since August 2022. Annual price changes in 8 out of 14 main cities have turned positive, and in Frankfurt — Germany’s financial hub — prices are close to break even after a year-on-year drop of more than 16% back in August of 2023, according to Immowelt’s data.

“Buyers are now more secure in what they can afford and demand for all kinds of residential properties has risen significantly,” said Silke Peschmann, the sales director for real estate brokerage Engel & Völkers in Cologne.

Prices in Germany have corrected much more strongly than in other European countries because the majority of people rent their homes, meaning consumers have the option to remain tenants rather than take out pricey mortgages.

That’s less of an option in most other major European cities, with shortages forcing buyers to absorb higher financing rates more quickly. According to the Bloomberg City Tracker, 8 out of 12 cities recorded gains in the most recent month. Berlin and Frankfurt are among the few decliners, while Paris is the biggest outlier, with home prices in the French capital declining 7.2% in June compared to a year earlier.

The rebound in Germany is part of a new era in European residential real estate. During the cheap-money era, prices were in part driven by debt-fueled investors seeking returns, but the current market is driven more by the basics of supply and demand and the dynamics are pushing prices higher.

More expensive financing has also hit builders, exacerbating the squeeze in housing. The Ifo Institute expects just 175,000 homes to be completed in 2025, nearly a third lower than in 2023 and less than half the the target set by Chancellor Olaf Scholz’s administration. Newbuilds generally cost more than existing homes, so the contraction has an outsized impact on market levels.

As supply shortages get worse, people who want to live in their own home are now returning to the market in larger numbers, said Martin Güth, senior economist at Landesbank Baden-Wuerttemberg. That means gains are likely to be more steady.

“Sharp price rises, such as we have seen in the past decade, are likely to remain history for the time being,” he said. “Purely looking at yields, residential real estate is still not really attractive,” he said.

For developers, the sudden drop off in demand was a difficult adjustment.

With hundreds of units to sell ranging from compact two-room units for €430,000 to family-sized four-room flats for €880,000, Swiss Life AM started in January to offer to pay the property transfer tax, a levy that amounts to as much as 6.5% of the purchase price. The advantage of the incentive is that it doesn’t come off the square-meter price and so doesn’t impact lending values.

“We wanted to draw in clients who had the funds available, but wanted to wait for the perfect time to buy,” Barsch said. The move paid off and the developer has sold almost all of the units in Viva Agrippina, which is scheduled to be completed in mid-2025.

Despite the revival of demand in an upscale Cologne neighborhood near restaurants, parks and the city’s zoo, the recovery is still limited to Germany’s thriving urban hubs. Less sought-after locations — and developers who invested in them — are still struggling and that might create a two-track residential market as population trends diverge.

While Germany’s largest metropolitan areas could grow as much 20% by 2040, the population in much of the rest of the country will decline and demand for new housing will shrink subsequently, according to Jochen Möbert, an economist for Deutsche Bank AG. Going forward, “prices for residential real estate will diverge accordingly,” he said.

The risk is that the divide between the haves and the have-nots grows. In an effort to close the gap, the German government has pledged more than €18 billion in state financing until 2027 to boost development of affordable homes.

“We need new construction on a large scale,” Scholz said at a building industry event in June.

So far, the announcement has shown little impact. Major German landlords like Vonovia SE have canceled new construction projects indefinitely, citing elevated costs and regulatory restrictions. Several smaller, debt-laden developers have already folded under the weight of higher financing expenses.

But for companies with cash and patience, housing developments that cater to residents rather than investors are still appealing.

“Selling apartments in good locations to owner occupiers makes the most economic sense right now,” said Swiss Life AM’s Barsch.

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg

- Biden’s Defiant Interview Unlikely to Calm Democratic Nerves

- A $14 Billion Walmart Heir Joins Novogratz Urging Biden Exit

- Singapore Is Making Life Tougher for Global Talent

- Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

- Trump Distances Bid From Second-Term Agenda Pushed by Allies

©2024 Bloomberg L.P.

2024-07-05T04:20:29Z dg43tfdfdgfd