DOLLAR WINNING STREAK EXTENDS INTO FIFTH WEEK AS YEN SLUMPS

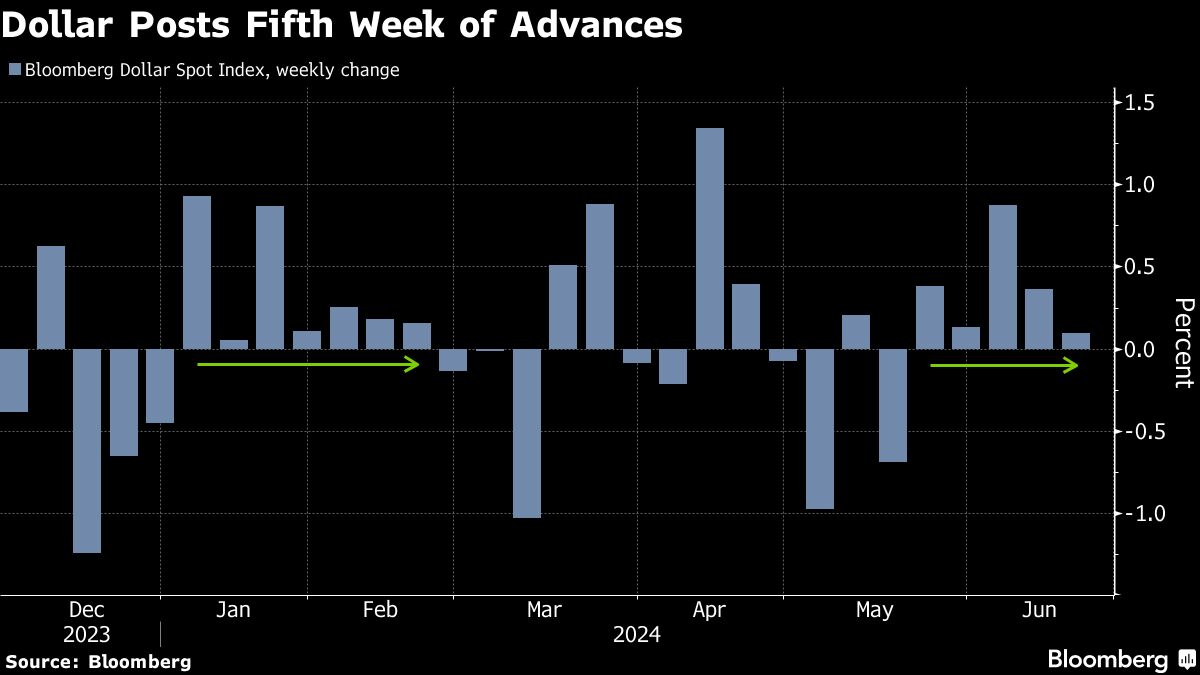

(Bloomberg) -- A key gauge of the dollar strengthened for a fifth week as the timing for the Federal Reserve’s first interest-rate cut remains cloudy.

The Bloomberg Dollar Spot Index edged 0.1% higher in the past five days, marking the longest stretch of weekly advances since February. The gauge ended the day at the highest level on a closing basis since early November.

The dollar’s resilience kept the pressure on peers this week, including the yen. The Japanese currency weakened for a 10th session in 11 on Friday, ending the session at 159.80 against the greenback — just shy of the closely watched 160 level. The British pound and Swiss franc also slumped.

“I don’t really see much to turn the tide for the dollar until the Fed cuts,” said Helen Given, a foreign-exchange trader at Monex Inc. “The yen and Swiss franc could stand to suffer the most through the next few months, until the Fed moves materially toward easing.”

US benchmark rates at the highest level in more than two decades are bolstering the dollar as traders look for signs the Fed is ready to pivot. This week, Chicago Fed President Austan Goolsbee said policymakers will be able to lower interest rates if inflation continues to cool as it did last month while Thomas Barkin at the Richmond Fed said he needs further clarity on the path of inflation before a cut.

What Bloomberg Economics says:

The outlook for the Fed remains in flux. The FOMC signaled in June that it will cut by only 25 basis points this year, down from the 75 bps it favored in March. Bloomberg Economics’ view, in contrast, is that decelerating inflation and higher unemployment will mean 50 bps of cuts - 25 bps each in September and December. With the Fed the anchor for other central banks, uncertainty there ripples across global forecasts - impacting everywhere from the Euro Area and Japan to Argentina and Turkey.

— David Powell, senior economist

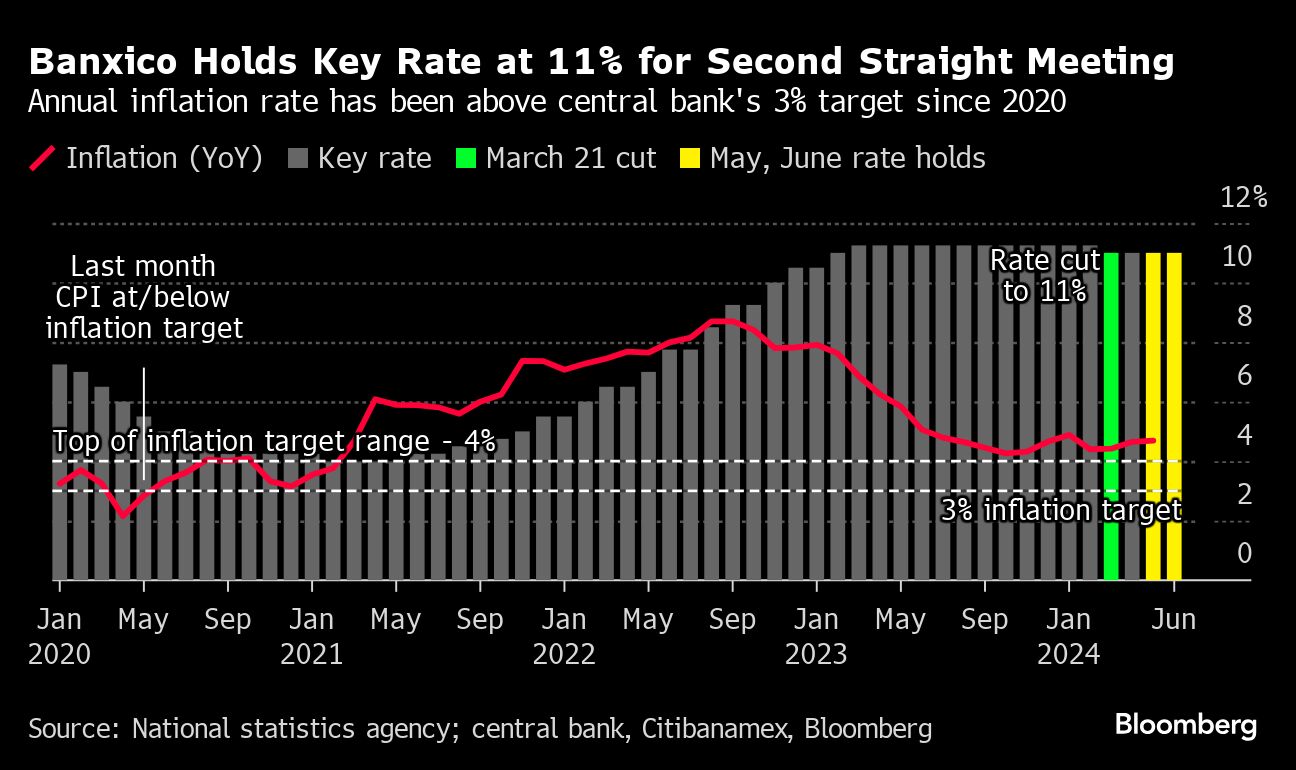

In contrast, many other central bank are starting to succumb to economic pressures and lower local borrowing costs, even as rate disparities with the US weigh on their currencies.

The dollar’s reign has wreaked havoc across currency markets, especially in Japan where ultra-low interest rates have sent the yen spiraling down against the greenback this year.

Authorities in Japan signaled that they are ready to take appropriate measures in the event of outsized currency moves. They have already spent a record amount to prop up the currency and dissuade speculative traders, to the tune of more than $60 billion in April and May.

Leveraged fund bets against the yen reached a record level in April on the gap between US and Japan’s rates, though bearish bets have since been trimmed. Their wagers against the Swiss franc reached the highest since November 2021 this month, with the currency losing about 6% against the dollar so far this year.

The franc weakened further after Swiss officials lowered the benchmark rate for a second-straight meeting on Thursday. The euro has fallen about 2% against the dollar since the European Central Bank cut rates on June 6.

While the dollar’s rally has been capped by the relative calm of financial markets, its strength looks poised to continue for now.

“That valuation premium will erode only very slowly and the dollar will remain stronger for longer,” Goldman Sachs Group Inc.’s Kamakshya Trivedi said by phone. “There will be two cuts from the Fed this year in the base case — still a pretty solid US growth picture, still a pretty solid US asset market picture.”

(Updates pricing throughout.)

Most Read from Bloomberg

- CDK Hackers Want Millions in Ransom to End Car Dealership Outage

- At Blackstone’s $339 Billion Property Arm, the Honeymoon Is Over

- Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns

- Wall Street’s Smart-Trade Brigade Thrashed Again on Stock Boom

©2024 Bloomberg L.P.

2024-06-22T06:04:22Z dg43tfdfdgfd